Tech in Africa has hit escape velocity. Newly minted unicorns. Tiger Global leading funding rounds. In many ways, the capital inflows into the continent’s ecosystems has matured more in the last year than the last 5 years.

With such growth naturally comes debate, especially when it comes to Nigeria’s fintech ecosystem. Some warn that the sector is overheated given broader macro trends. Others counter with the idea that, as a discount on the future, we are just getting started. The polarizing nature of record-setting valuations won’t be contained to Nigeria — this is coming to a market near you.

At the end of 2020, we wrote about the Frontier Blindspot, a phenomenon when investors and others overestimate the speed of digital progress in Africa while underestimating the progress brought on by the continent’s builders. While the abundance of capital, valuations, and resulting expectations have likely reduced some of that underestimation of African founders, we are unconvinced that the needle on digital progress has been fundamentally shifted, yet.

Part of this is simply due to the absolute amount of capital we’re talking about. I have been tracking Africa’s VC funding compared to Southeast Asia’s and an interesting pattern emerges if you place a 5-year lag on the numbers — the regions nearly match. For example, VC into Southeast Asia hit $1.16B in 2014 and $1.72B in 2015. Fast-forward five years from then, VC into Africa hit $1.12B in 2019 and $1.6B in 2020.

In 2016, Southeast Asia hit $3.09B in VC funding. As of October 2021, Africa hit about $3B in VC funding, even before the year-end housekeeping that usually adds much more to the final tally. While the trend is indeed encouraging, VC in Africa today is comparable to the Philadelphia region in the U.S., where VC funding hit about $1.47B in 2020 but has doubled already to $3B by the first half 2021. The Philadelphia region is home to 4 million people.

While it’s an unfair comparison (goPuff’s $1.15B round buoyed those numbers), it does help to put into context around what is strong VC growth versus what is an amount of capital that’ll shift the fundamentals of digital development for a continent.

But then one might ask what does the latter look like? Reliance Jio in India gives us a clue.

Between 2010 and 2017, Reliance spent $32 billion of its own money and debt to build out a nationwide 4G network focused exclusively on data, not traditional 2G and 3G circuit-switched telephony services. That decision meant that voice could be handled over the data network for a fraction of the cost. As Ben Thompson wrote in India, Jio, and the Four Internets, Reliance’s strategy with Jio was the classic technology play: massive upfront costs with near-zero marginal costs. It spent $32 billion to build a 4G network that covers all of India, and offered three to six months of free data and voice to acquire as many customers as quickly as possible.

$32 billion over seven years. And what did this result in? 400 million subscribers exhibiting fundamentally different (increased) digital behavior.

[Reliance Jio brought] about a mobile revolution with Jio Platforms, slashing data costs by 95% since 2013 and driving a 20x increase in Indian data consumption to 8.3 GB/mo/user, on par with South Korea.

To be clear, this isn’t a call to cut and paste the Reliance Jio playbook. Even if a similar scale of investment were possible, India is not Africa, a continent with 54 countries. This also isn’t to say there isn’t progress — MTN Nigeria has plans to invest $1.5B over three years to boost 4G and rural home broadband.

But this does put into perspective what $3B of VC funding actually means to a continent that would require many multiples of that amount in hard infrastructure investment to dramatically shift the connectivity landscape, not to mention the regulatory and political hurdles.

Let’s set that aside for now.

Another piece we dove deeply into as we formed our thesis around the frontier blindspot is an undeniable ceiling on consumer purchasing power. We simply asked, “how many people consume more than $10 a day?” The answer — about 5% of the African population, scattered across multiple countries. See the green bars below:

Unlike the hard physical limits imposed by lack of digital infrastructure, consumption ceilings can be cast aside, and as mentioned above, Reliance Jio did just that initially. If an offering is free — or even better, subsidized — then the consumption ceiling itself is moot. Temporarily.

But two questions immediately follow. First, how long is “temporarily?” Some argue that a 20-year or longer timeline is the competitive advantage well-funded teams are aiming for here.

The follow-up question then might be “what changes during that time?” To this question, we have those pointing decisively at Silicon Valley and an assumption of Compounding Crazy, that maybe we are at the beginning of an epoch of exponential progress, underpinned by unfettered access to decentralized technology. To quote Packy McCormick:

Even before accounting for cheap, fast internet everywhere, regions like Africa, Southeast Asia, and India are poised to experience enormous growth over the next couple of decades, enabling new innovators and billions more people in the global middle class. Increased digitalization, remote work, and crypto will knock down borders and level the global playing field in the coming decades.

Enabling billions of people, including lower-income Africans, to enter into the global middle class is a goal worth building towards and investing in. We founded DFS Lab with that vision in mind. However, to answer the question of “what changes during that time?” for Africa’s context using exponential growth curves applied to digital-first futurism isn’t practical enough. You can’t feed your corporeal self in the metaverse.

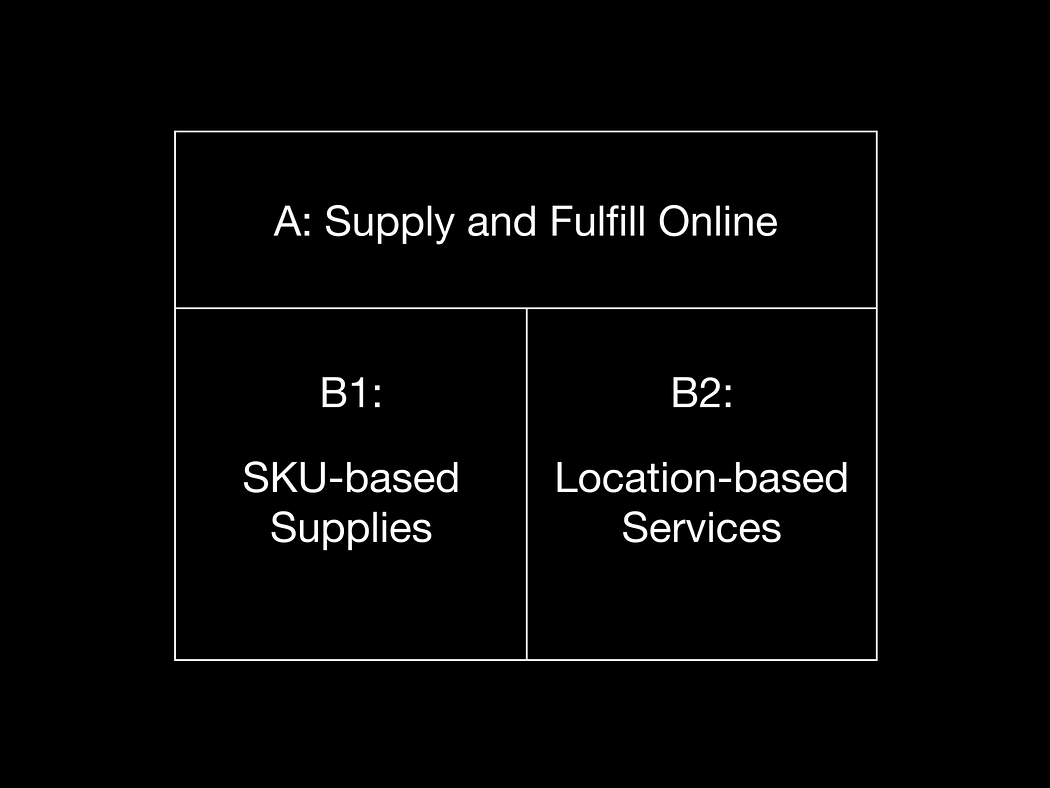

Let me take this into another direction that still assumes compounding and a bit of crazy. We had previously written about our thoughts on physical ubiquity during the pandemic and trends we were tracking. I recently came across an article originally written by Wang Huiwen (translated by Tao Huang), co-founder of Meituan Dianping, one of the largest on-demand delivery platforms in the world with approximately 570M paying users. Wang wrote that if one had to categorize the “internet industry” in one cut, you could split it as follows:

Wang looks at technology platforms and splits approaches between Side A, which favors digital ubiquity, and Side B, which favors physical ubiquity. If you were to apply this chart to most African economies, a snapshot of the addressable market for Side A would be a sliver while Side B would be take up the majority. The reason is covered above, that fully digital experiences are either inaccessible, unaffordable, or don’t cover the primary consumption needs for those in the bottom 95%.

Side A is how most imagine tech startups and where ecosystems in digitally ubiquitous countries have traditionally been pushing the envelope. Side A is social media, SaaS, and where fintechs are most comfortable. Side A has been immortalized by the post dot-com bust and rise of Silicon Valley and its well-deserved reputation around the world. But then again, you can’t eat Side A.

And so we come to Side B. Here, Wang splits Side B into two further breakouts:

B1 companies are distinguished by their understanding of supply chains, SKUs, and pricing.

B1 pioneers in Africa include companies like Twiga Foods and Sokowatch. One might also argue that wholesale logistics startups like Lori Systems and Kobo360 and shipping startups like SEND and Sote all fit within B1. More recently, we have seen startups that aim to digitize inventory management, accounting, and other backend processes for small retail in Africa, another push into B1 inspired by startups in Asia like Khatabook and BukuWarung.

And there’s plenty of upside in building B1 businesses. B1 touches most of the “real” economy because it leverages technology to improve the efficiency of existing value flows and in doing so, reorganizes pricing power within those flows. Its focus is on flattening supply chains and delivering better prices, selection, and service to customers.

However, I promised compounding crazy, not just “digital transformation.” So let’s talk about B2.

According to Wang, B2 companies are defined by location-centricity, a physical network of merchants, and timely last-mile fulfilment. If B1 is the empowerment of brick-and-mortar retail in Africa, then B2 is its disintermediation.

B2 is physical ubiquity, and it’s very familiar to parts of Africa because the clear, pioneering example of B2 on the continent is mobile money, a human ATM network that disintermediated the brick-and-mortar bank branch. Mobile money networks offer:

- Location-centricity— an agent on every corner

- Physical network of merchants — or agents

- Timely, last-mile fulfilment — provides on-demand financial and increasingly, other services

Most critically, mobile money is compounding crazy.

If someone told you in 2007 (when M-Pesa launched) that in 2021, Africa’s fintech revolution would be underpinned by an obscure, offline protocol from nearly 25 years ago, you’d be confused. If you then learned that revenues from this network far exceeded traditional digital banking revenues by multiples, you’d be incredulous. But here we are.

Beyond mobile money, physical ubiquity offers incredible upside for a much broader base of stakeholders in the digital economy. As we’ve written before:

An ecosystem that enjoys physical ubiquity is a hyper-market creator. It asks everyone the question “if you could deliver anything to anyone, what would you sell?” Importantly, this is a question that can be answered by every restaurateur, “mom-and-pop” shop owner, and smallholder farmer in the country in contrast to the question digital ubiquity offers, which is: “if you could deliver any software or content to anyone, what would you build?”

While nascent, there are B2 trends worthy of close attention including:

- Social commerce — the buying and selling of goods and services over social media or networks, currently on WhatsApp and Instagram, and the digital+physical infrastructure that supports these sellers.

- Dark stores — delivery-only retail warehousing that holds inventory and enables hyper-quick (<1 hour) last-mile fulfilment.

- Cloud kitchens — internet and delivery-only food brands that cater to local tastes and pricing.

- Agent-based services — an extension of the mobile money agent model to include a hub of ecommerce, logistics, among other services.

Just like how a tech stack consisting of cloud storage, enterprise SaaS, digital payment APIs, and others flattened the time and cost it takes to spin-up a software company, B2 companies do the same thing to the time and cost it takes to start a retail business.

- Physical storefronts to social media profiles and agent networks

- Signage and billboards to omnichannel CRM

- Kitchens and warehouses to on-demand dark spaces

- In-house delivery to third-party logistics (3PL)

The physical ubiquity flywheel really clicks into place when you combine the supply chain and inventory benefits enabled by B1 companies alongside the local fulfilment capabilities offered by B2’s stack of services.

These are trends that are well under way in other markets. B1 startups have dominated headlines in Asia with early successes like Khatabook (India), BukuWarung (Indonesia), and Frubana (Colombia), just to name a few.

As for B2 startups, there are more than two dozen dark store/kitchen startups in Europe, commanding almost $3B in investment in 2021 alone. In Latin America, there’s pioneers like Merqueo (Colombia, Mexico, Brazil) while regional juggernaut Rappi has started to expand into the space as well. India is already wrestling with the digitally-enabled neighborhood retail vs. dark store question, with leading players like FlipKart adopting the dark stores approach.

In Southeast Asia, a region we think often signals what’s coming up in Africa, Foodpanda (Malaysia) launched its first Pandamart dark stores at the end of 2020 and has doubled its locations in 5 months. In Indonesia, Grab launched its own GrabSupermarket dark stores during the same time. A search for cloud kitchens yields just as many hits in emerging markets around the world (examples 1, 2, 3).

Here’s another layer of crazy to compound: even though B2 business models, especially dark stores/kitchens, have much better unit economics (think 3X improvements) compared to traditional retail, you aren’t going to enjoy SaaS-tier margins — until you start embedding fintech. And now we’ve come full circle.

It’s no secret that many of Africa’s fintech founders are building for customers that have financial lives more similar to themselves than to 95% of the population, with a vision that those 95% eventually move up the income and digital adoption ladders over the next handful of years. This “build it and they’ll come” strategy has resulted in the above mentioned arguments pitting digital futurism of 20 years later against the consumption ceilings of today and unicorn valuations against $10/day economies.

As Side B startups begin to hit their stride, they’ll create a bridge for fintech founders to build for the mass market today— certainly not the entire bottom 95%, but likely enough to justify venture-level returns. It’s already starting with agent networks and B1 companies aggregating small merchants, but will only compound as B2 companies open up further opportunities in physically ubiquitous markets.

Instead of free or subsidized, embedded services will align with income growth. Earning a margin on income generation is sustainable in Africa — just look at the commission structure for mobile money agents.

It is time for African founders to better leverage emerging market tailwinds to their advantage. Wang Huiwen writes when comparing China to the U.S. that there are four main advantages that China has over the States:

- Population size (oft-cited in African VC)

- Population density and urbanization

- Cheaper labor costs that enable cost-effective, large-scale physical fulfilment

- “Generational competition” or what we’ve highlighted in the past as Invested Infrastructure

That last one is key. Here’s how Wang characterizes Meituan’s impact on the food delivery industry:

When we started, we were not just bringing the Internet to the food delivery industry, we were building the food delivery industry itself. In fact, since we’re building the food delivery industry itself, our impact to the industry is much greater than just [digitizing] the industry [and] our commercial value would also be greater.

There are venture-level returns to be earned in Africa, but compounding will not happen if we are satisfied with just “bringing the internet” to [insert] industry on the continent, especially if most are excluded from said internet. Here’s a chance to work towards a future where market opportunity is available to everyone on the continent, underpinned by the advantages that already exist in “informal” commerce, and is dramatically accelerated by tech.

We’ll be here to back founders who are crazy enough to build it.

Originally published on Oct 19, 2021